How to Manage Your Retirement Corpus Wealth

A practical guide to converting your life's savings into income that lasts your lifetime.

Retirement is often treated like a finish line. In reality, it is a 20-30 year phase of life that demands as much financial discipline as your working years, sometimes more. People are living longer, medical costs are rising, and family support patterns are changing. You don't just "accumulate" wealth anymore you have to manage it intelligently in retirement.

In India, this responsibility is increasingly individual, personal. Between NPS and Atal Pension Yojana, over 9 crore Indians now participate in formal pension systems and together they manage more than ₹16 lakh crore in corpus. Those numbers sound reassuring, but they don't solve an individual problem: how do you convert a one-time corpus into income that lasts?

The truth is that sometimes people don't fail in retirement because they didn't save. They fail because they didn't manage what they saved. They kept too much money idle. Or too much money at risk. Or they underestimated inflation. Or they bought products with fees that quietly drained returns. If there is one skill that matters after age 55, it's not "where do I invest next?" it is "how do I withdraw, rebalance, protect, and preserve?"

This is a guide written in that spirit; it gives you seasoned principles that allow wealth to last.

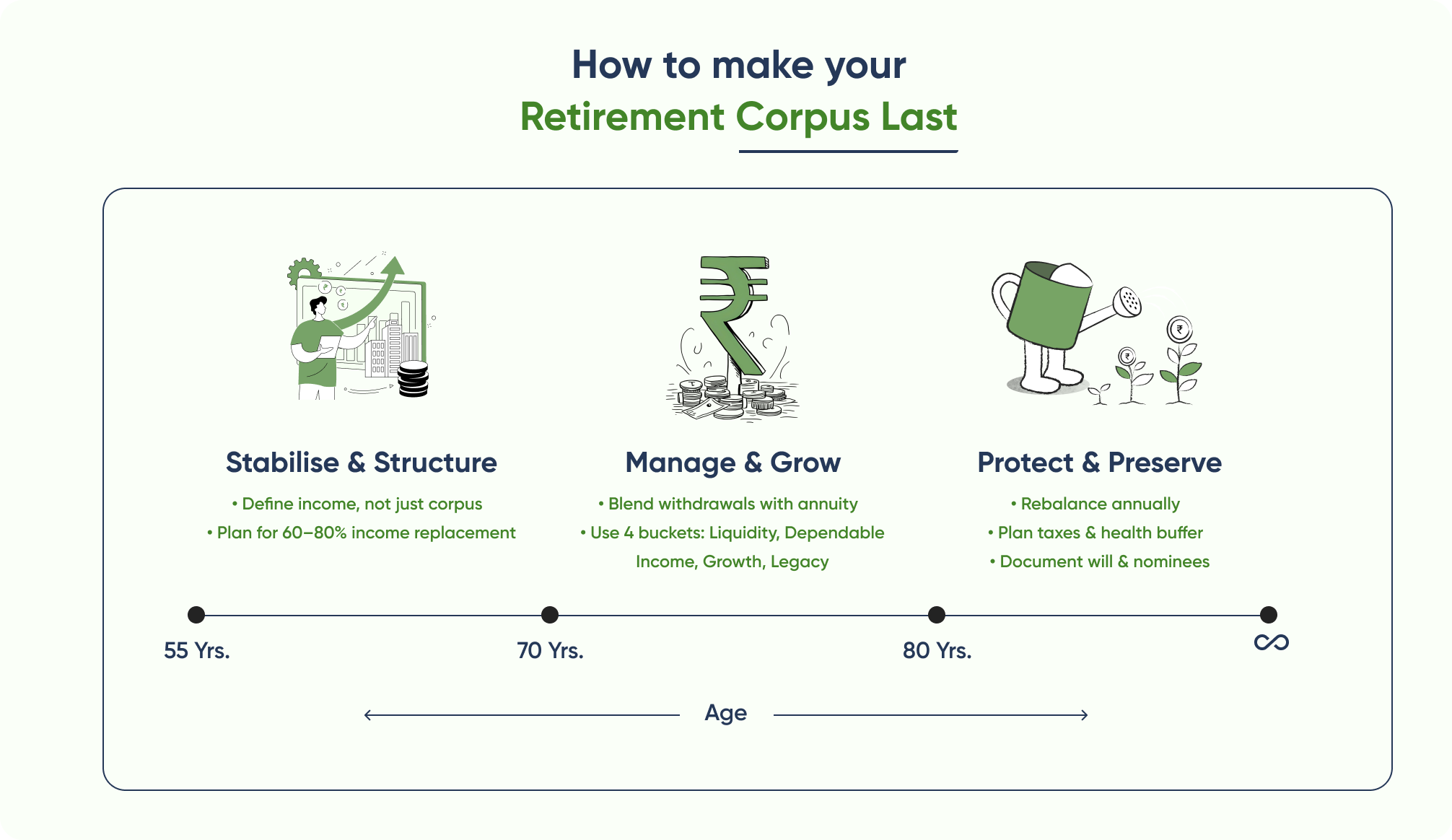

How to actually assemble these pieces in 2025

Define income, not just corpus

People obsess over the total amount, but struggle to describe the total purpose. So start with life, not money. What will your retirement month actually look like? What is non-negotiable? What is enjoyable? What is optional? A useful method is the replacement rate in simple terms, what percentage of your current monthly income will you need after retirement. Many financial planners suggest a 60-80% replacement rate, adjusted for personal factors like housing, dependents, and health conditions.

That number gives you perspective. Suddenly a ₹1 crore corpus is not "a big round number" it is a machine designed to produce income, month after month, in real terms, after taxes, and after inflation. When you shift your thinking from "how much do I need?" to "what do I want this corpus to do?", the decision-making becomes calmer and clearer.

Converting a lumpsum into steady income (and why timing matters)

There are two broad mental models for turning corpus into income. One is the withdrawal approach: you invest the corpus in a diversified portfolio and withdraw 3-4% annually, based on research that aims to avoid outliving wealth. The other is the annuity approach to convert a portion of money into a guaranteed lifetime pension, using an annuity product, and keep the rest invested for growth.

Neither is perfect on its own. The withdrawal method gives flexibility but exposes you to market risk and sequence-of-returns risk (a bad first 5 years in retirement can punish your corpus for decades). The annuity method guarantees income but limits growth and liquidity. Many retirees I've worked with take a blended approach: secure the basics with guaranteed income, and protect aspiration with market-linked growth.

Keep assumptions realistic. Annuity rates in India typically fall in the 5-7% band depending on age and product options. If someone promises "double digit pension," pause, breathe, and ask to see the math and charges attached.

The four-bucket mentality that reduces regret

One of the most helpful frameworks we've seen over the years isn't complex or technical - it's psychological.

-

Liquidity

Money for the next 1-3 years of expenses without touching anything volatile. Bank deposits, short-duration debt funds, government securities - safe, predictable, boring. This is the money that stops you from selling equity in panic during a market fall.

-

Dependable income

Money for the next 1-3 years of expenses without touching anything volatile. Bank deposits, short-duration debt funds, government securities - safe, predictable, boring. This is the money that stops you from selling equity in panic during a market fall.

-

Growth

Equities, balanced funds, or high-quality corporate debt. This is not for the next 2-3 years - it's for the next decade. It keeps your purchasing power alive when inflation quietly erodes everything else.

-

Aspirational / Legacy

This bucket is often ignored, but it matters emotionally and financially. It includes money earmarked for large one-time spends (a child's wedding, gifting, travel in early retirement years) or legacy planning. This prevents overspending from other buckets and keeps long-term compounding intact.

When retirees use this structure, emotional decision-making softens. There is clarity in purpose. You stop treating all money as equal and that is a surprisingly big milestone.

Markets will move. Your portfolio will drift. The bucket that was 50% equity may become 64% or 38% over time. That is normal. The mistake is not rebalancing back to intention.

Rebalancing: the quiet discipline that protects capital

Rebalancing is simple but powerful: you sell portions of assets that have grown too much and buy assets that have lagged. That feels counter-intuitive - why sell what's winning? - but mathematically it locks in gains and restores stability.

A more detailed approach:

- Most veteran planners rebalance annually or when allocation drifts 10

percentage points from target

Rebalancing typically happens within buckets, not just across them - Equity rebalancing is more important after bull runs and after big market declines, not during minor volatility

- Use a predetermined rule: for example, if equity crosses 60% in a 50:50 plan, trim back to 50%

Think of it less like trading and more like pruning a garden - steady, gentle maintenance so nothing grows wild enough to threaten everything else.

Taxes matter more in retirement than you think

You can lose more wealth to poor tax decisions in retirement than to poor investment decisions. That sounds exaggerated, but stay with it. When working, taxes are predictable. In retirement, they are optional depending on what you withdraw, how you structure it, and when.

Annuity income is often taxable. Lump sum withdrawals from various pension schemes are partly tax-exempt, partly not. Timing matters. Sequencing matters. Tax brackets matter. A good retirement plan is not just "where the money is invested," but "which money is withdrawn first." A simple spreadsheet projecting 10 years of withdrawals and tax treatment is worth more than a 200-page product brochure.

To manage this: use a withdrawal order strategy to exhaust tax-free components first, use SWPs from debt or hybrid funds to stay within lower slabs, and push taxable annuity/interest income into years where your expenses or withdrawals are lower.

Health is the biggest unseen liability

No matter how elegant a retirement strategy looks on paper, it can collapse under medical shock. Healthcare inflation in India typically runs higher than general inflation. Ageing populations exacerbate this. UNFPA data expects India's elderly population to grow significantly through 2050. Planning without a healthcare buffer is planning for surprise. Keep insurance active. Consider senior-specific cover or top-ups. Maintain a separate liquid reserve for medical emergencies. It's okay if this reserve never earns aggressive returns. Its job is not growth, it's protection of everything else.

To manage this: treat healthcare like its own bucket, maintain a dedicated emergency fund, buy/renew senior health cover early, and keep critical illness cover active where possible.

Create a playbook your future self can follow

Money is managed by decisions. Good decisions are made early, calmly, and while capacity is intact. Document your retirement plan: who can access accounts, what percentage to withdraw each year, which bucket to tap first, and when to review. Nominee and will paperwork seems tedious until you watch a family run from bank to bank trying to locate accounts because someone didn't write things down. This isn't finance. It's dignity.

Retirement corpus management is steady work. It is not about finding the "next opportunity" or chasing returns. It is about developing a temperament that values consistency over excitement, and survival over bragging rights. Your goal isn't to "beat the market." It is to outlast life. To stay independent. To maintain choice. To sleep well. To protect the people you love from financial uncertainty when they already will be carrying an emotional burden.

Wealth isn't what you accumulate. In retirement, wealth is what you retain, protect and use wisely. That is where financial freedom truly lives.