Maximising Your Retirement Planning & Options in 2026

How to build a tax-efficient, inflation-proof retirement plan by combining government schemes, market instruments, and smart timing

India's retirement landscape is undergoing its most dramatic shift in decades. Interest rates don't stay high long enough, inflation quietly chews through cash left idle, and our life expectancy has climbed steadily which means the traditional “pension + PF + a few FDs” approach no longer guarantees comfort. Even tax rules and small savings rates change faster than most households can track. What used to be a simple, almost casual question “PPF kar loon?” has now become a far more strategic conversation about stability, liquidity, inflation protection, and taxation.

The RBI's policy actions in mid-2025 were a turning point. A series of rapid rate cuts pulled fixed-deposit rates down almost overnight. Savers who locked in 8%+ with small finance banks were lucky; that window closed within weeks. Everyone else was left looking at sub-8% options while deciding how much risk they were really willing to take with smaller banks. The lesson was unmistakable: retirement cannot lean solely on bank deposits. The strongest plans are those that combine tax-free compounding, guaranteed returns, floating-rate stability, and market-linked growth, each playing a different role across decades.

The bedrock: PPF, SSY, NPS, EPF and the power of tax-free compounding

A stable retirement corpus begins with products that let compounding do the heavy lifting without letting taxes dilute gains.

- PPF (Public Provident Fund), with its 15-year lock-in and tax-free maturity, consistently beats taxable FDs on a post-tax basis even when FD headline rates seem higher. Current PPF interest rate is at 7.1%

- SSY (Sukanya Samriddhi Yojana) available only for girl children currently offers 8.2% tax-free, the highest guaranteed tax-free return in India. For families with daughters, it becomes a strategic pillar that frees up future cash flows during the parents' retirement years

- EPF (Employees' Provident Fund) continues to be one of the most reliable long-term compounding engines for salaried individuals, with its interest (currently 8.25% for FY25) and maturity proceeds both tax-exempt subject to contribution rules

- NPS (National Pension System) remains arguably the most underrated retirement instrument in India, especially for high-income earners. Apart from the additional ₹50,000 deduction under Section 80CCD(1B), its ultra-low fund-management charges make it one of the most efficient ways to build a long-horizon, equity-plus-debt portfolio

These four are the “silent workers” of a retirement plan, slow, steady, disciplined, and extremely tax-efficient.

The income layer: SCSS, PMVVY, POMIS and predictable cashflows

Once the long-term compounding engines are set, retirees turn to products that offer stability and regular income:

- SCSS (Senior Citizens' Savings Scheme) remains one of the safest ways for seniors to earn high, government-backed quarterly interest.

- PMVVY (Pradhan Mantri Vaya Vandana Yojana), available via LIC, allows senior citizens to lock in a predictable monthly or annual pension-like income for 10 years.

- POMIS (Post Office Monthly Income Scheme) offers consistent monthly payouts - a workhorse for households whose post-retirement expenses remain high, especially where loans, medical costs or dependants continue.

This layer ensures liquidity and predictability, essential during retirement years.

Inflation protection: why even retirees need equity

No retirement portfolio can completely eliminate equity. Even a 10-30% exposure through broad-market index funds can be the difference between merely surviving retirement and living it comfortably. Indian equities, despite volatility, have historically delivered inflation-beating returns of 10-12% over long horizons. Young earners may prefer pension ULIPs for automated, long-term disciplined investing, while mid-career professionals often gravitate towards low-cost index funds and hybrid allocations.

A forgotten hero: Floating Rate Savings Bonds (FRSB)

One of the most insightful trends of 2025 highlighted sharply in The Ken's reporting was how Floating Rate Savings Bonds remained resilient even as FD rates collapsed. Pegged to the NSC rate and reset every six months, FRSBs have consistently provided yields around the 8% mark without the volatility of market-linked products. Their lack of an investment cap, combined with government backing, makes them a powerful stabiliser in an environment where interest-rate cycles are increasingly unpredictable. They do come with a 7-year lock-in and taxable interest, but for those seeking dependable rate protection, FRSBs occupy a special niche.

The invisible multiplier: tax optimisation

A surprising portion of retirement wealth isn't created through returns, it is created through tax efficiency. A 7.1% tax-free PPF return is equivalent to earning over 10% in a taxable instrument for someone in the 30% bracket. SSY's 8.2% becomes the equivalent of 11.7%. At the same time, an 8% FD quietly shrinks to just 5.6% post-tax. When you compound that gap over 20-25 years, the difference is staggering.

Which is why professionals who plan well use the full spectrum of deductions 80C for PPF/SSY/ELSS, 80CCD(1B) for that extra NPS contribution, 80D for medical insurance while complementing them with prudent capital-gains harvesting and the right mix of taxable vs tax-free income.

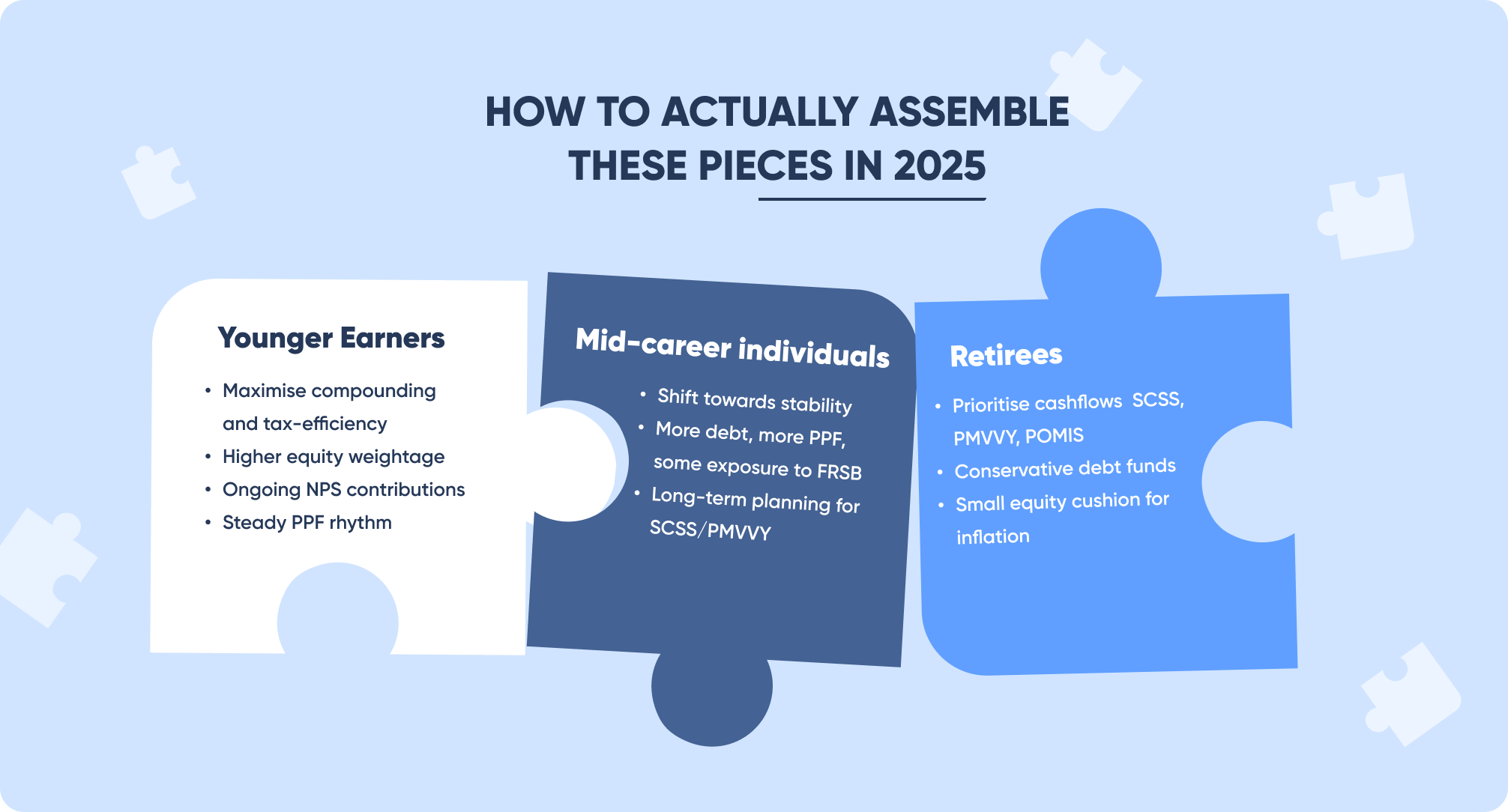

How to actually assemble these pieces in 2025

For younger earners, the goal is to maximise compounding and tax-efficiency: higher equity weightage, ongoing NPS contributions, and a steady PPF rhythm. Mid-career individuals gradually shift towards stability: more debt, more PPF, some exposure to FRSB, and long-term planning for SCSS/PMVVY. Retirees prioritise cashflows SCSS, PMVVY, POMIS, conservative debt funds while still keeping a small equity cushion for inflation.

Across all age groups, the principle remains the same: long horizons need growth, uncertain cycles need stability, and retirement itself needs liquidity.

Three veteran rules that remain timeless

First, tax-free compounding is more powerful than chasing high interest rates. Second, whenever the interest-rate cycle briefly turns favourable, locking into long-term instruments pays off far more than trying to time the next move. And third, retirement isn't a 5-year window; it's often a 25- to 30-year phase where some equity exposure is essential, not optional.

A good retirement plan isn't built on one product. It's built on layers of tax-free foundations, floating-rate cushions, guaranteed income streams, and long-term growth engines. When these elements work together, they protect you from falling rates, rising prices, and the uncertainty of long life. That blend, not any single hero scheme, is what creates a retirement that feels safe, flexible, and financially dignified.