Multiple Scheme Framework (MSF) Explained: A Smarter National Pension System (NPS)

The National Pension System is becoming smarter and more adaptable -- giving you the freedom to shape your retirement savings your way, with full clarity and control.

Retirement planning in India has long struggled with a “one-size-fits-all” problem. The Multiple Scheme Framework (MSF) under the National Pension System (NPS) is designed to solve exactly that.

Think of MSF as a personal investment blueprint rather than a rigid pension plan. It allows every NPS subscriber to design their own mix of investment schemes – balancing growth and stability in a way that suits their life stage, profession, and risk appetite.

By bringing flexibility and personalization to the forefront, MSF makes the NPS more inclusive – whether you are a young professional starting your savings journey, a mid-career employee consolidating wealth, or a gig worker seeking financial security in an unstructured work life.

The Multiple Scheme Framework: How It Works

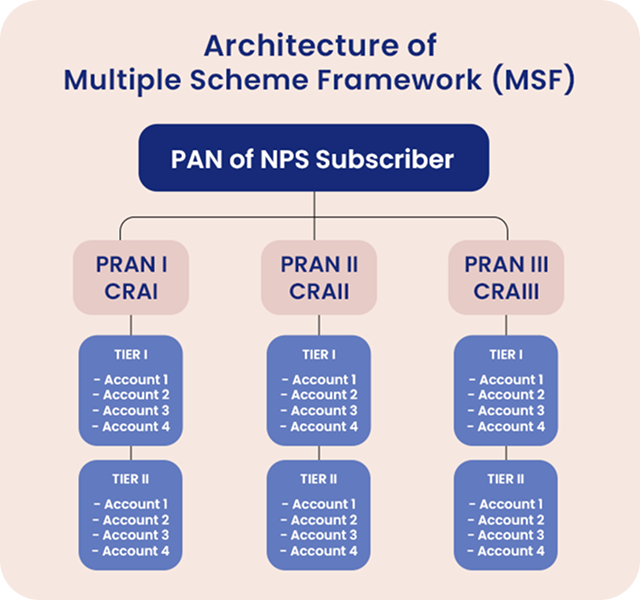

At its core, MSF allows you to hold multiple scheme variants under a single Permanent Retirement Account Number (PRAN) – without the need for separate accounts or complicated paperwork. Additionally, it’s possible to have multiple PRANs under different Central Recordkeeping Agencies (CRAs), giving you even more flexibility to manage and diversify your retirement investments

You can now allocate your NPS contributions across different schemes–equity, corporate bonds, or government securities–depending on your goals and risk tolerance. This multi-scheme setup can be used in both Tier I (retirement-focused, with withdrawal rules) and Tier II (flexible, no lock-in) accounts.

Your investments continue to be professionally managed by licensed Pension Fund Managers (PFMs), who operate under the regulatory oversight of the Pension Fund Regulatory and Development Authority (PFRDA).

Each scheme’s performance is benchmarked and published regularly, with daily NAV updates and clear disclosures–giving you complete visibility into how your money is growing.

Example:

For example, an investor could put money into HDFC Pension Fund’s Growth Scheme and ICICI Pension Fund’s Wealth Builder Scheme at the same time, combining two different investment styles to make their NPS portfolio stronger and more balanced.

In short, MSF is like a personal toolbox for your NPS account, letting you diversify, manage, and optimize your retirement savings without unnecessary complexity

Why MSF Is a Step Forward for Savers

The introduction of MSF marks a shift from passive to participatory retirement planning. It empowers savers to become active architects of their financial futures, rather than mere contributors to a preset formula. Under the traditional system, investors had to pick one Pension Fund Manager and largely stick with their chosen investment style. With MSF, that limitation disappears. Savers can now design a portfolio that evolves with their goals, life stage, and market outlook — all within one NPS account.

-

Choice:

Access multiple NPS schemes – ranging from high-growth to conservative options – within a single account, making it easier to diversify across risk levels without managing multiple portfolios

- Flexibility:

Adjust your allocations as life evolves. Go heavier on equity in your early years to capture long-term growth, then gradually move toward balanced or debt options as retirement approaches, keeping your savings aligned with changing priorities

- Transparency:

Every scheme’s mandate, benchmark, and NAV movement is openly reported, allowing investors to see exactly how their money is performing and to make informed, data-backed decisions with confidence

Real-World Relevance: Who Stands to Gain

The MSF framework isn’t designed only for a specific investor profile – it opens up smarter planning possibilities for every kind of saver. Whether you’re just starting your career, balancing midlife financial goals, or building a business, MSF adapts to your reality.

-

Young professionals:

Can allocate up to 100% in equity for long-term growth, taking advantage of time and compounding, and later rebalance toward stability as responsibilities grow

-

Mid-career employees:

Can blend moderate and conservative schemes to preserve accumulated wealth while continuing modest, steady growth as they approach retirement

-

Gig workers and entrepreneurs:

Can use a single NPS account to manage both aggressive and defensive strategies, bringing structure and discipline to long-term planning without the hassle of multiple investments

-

Corporate employees:

Can benefit from employer-assisted scheme selection or structured advisory that helps tailor retirement planning to different career stages and financial milestones

Case in Point: UTI Wealth Builder NPS Equity Scheme

To see the power of MSF in action, look at how it opens doors to more tailored investment opportunities within the NPS ecosystem. One such example is the UTI PF Wealth Builder NPS Equity Scheme, designed for investors who want to tap into India’s growth story beyond large caps. This scheme focuses on emerging mid-sized companies, offering 90–100% equity exposure for both Tier I and Tier II accounts – ideal for those with a higher risk appetite and a long investment horizon.

While the portfolio is aggressive in nature, it doesn’t compromise on discipline. Robust risk management frameworks, transparent benchmarking, and continuous oversight by the Pension Fund Manager ensure that even high-growth strategies remain grounded in market realities and aligned with investor protection norms.

Questions Every Investor Should Ask

Diversification under MSF brings freedom, but it also calls for self-awareness. Before you start splitting your corpus across multiple schemes, it’s important to pause and think through your personal financial landscape. Asking the right questions can help you make smarter, more sustainable allocation decisions:

- What’s my risk tolerance?

Higher equity exposure can amplify long-term returns but also increase short-term volatility – know how much uncertainty you can truly stomach

- How long till retirement?

MSF rewards consistency and patience; the longer your investment horizon, the better you can harness compounding and ride out market swings

- What life goals do I want to align with my NPS?

Use different schemes strategically – not just for retirement income, but for broader life milestones like buying a home, funding education, or creating a safety net for loved ones

Costs and Charges in MSF

While MSF gives flexibility, it’s important to be aware of the costs involved:

- Fund management charges (FMC):

Each scheme under NPS has its own FMC, typically ranging from 0.01% to 1% per annum, depending on the fund manager and scheme type

- Account maintenance charges:

A small annual fee is levied for managing your PRAN '

- Switching charges:

When moving your allocation between schemes under MSF, nominal charges may apply, usually minimal

- CRA fees:

If you hold multiple PRANs across different Central Recordkeeping Agencies, separate CRA fees may apply

Even with these costs, MSF allows diversification and tailored investment strategies, often outweighing the minimal fees involved

Restrictions on Switching and Withdrawals

Existing NPS subscribers cannot transfer their current holdings from the Common Schemes to the MSF structure. The MSF accepts only fresh contributions, which means investors must open a new account to participate in this framework

Liquidity is also limited under MSF:

- Withdrawals before age 60 are not allowed, ensuring the focus remains on long-term retirement savings

- Switching between MSF schemes is permitted only after 15 years, effectively acting as a vesting period

These rules reinforce NPS’s identity as a long-term, retirement-focused investment vehicle, rather than a flexible short-term option

Newly-launched NPS Schemes and Their Asset Allocation

For investors looking to diversify within NPS, here’s a snapshot of some pension funds and their scheme-wise asset allocations:

The Broader Picture

MSF represents more than a regulatory tweak–it’s a structural modernization of India’s retirement ecosystem. By introducing personalization, flexibility, and market-linked transparency, NPS is evolving into a truly contemporary pension vehicle aligned with global best practices.

At a time when the Indian workforce is increasingly diverse–spanning salaried professionals, entrepreneurs, freelancers, and gig workers–MSF ensures that retirement planning adapts to the individual, not the other way around.

Bottom line:

The Multiple Scheme Framework is a progressive step in India’s journey toward financial empowerment. It allows every saver to build a retirement portfolio that mirrors their life, risk preferences, and aspirations.

It’s not just about growing a pension corpus–it’s about giving every Indian the tools to design their own version of financial independence.