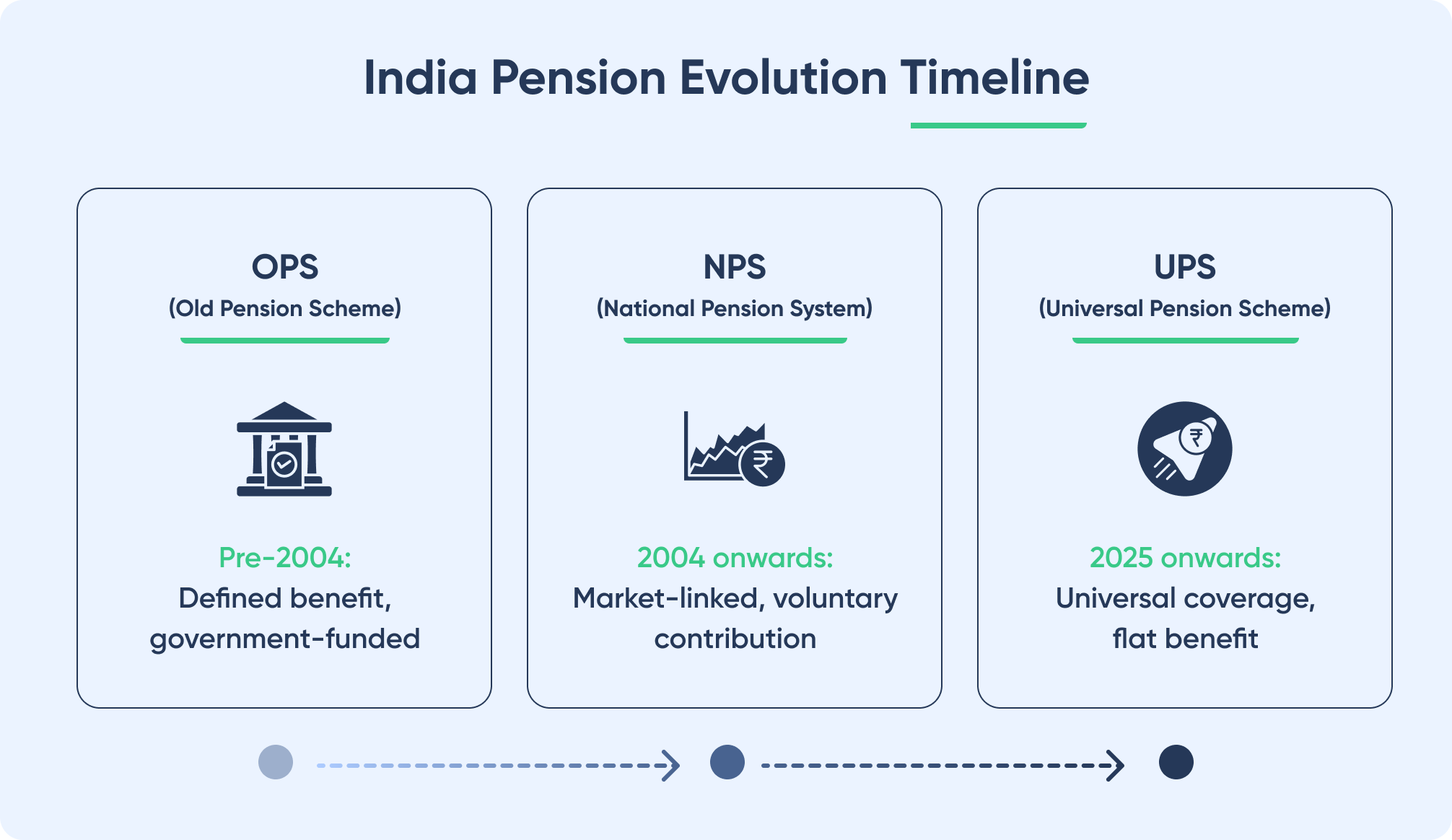

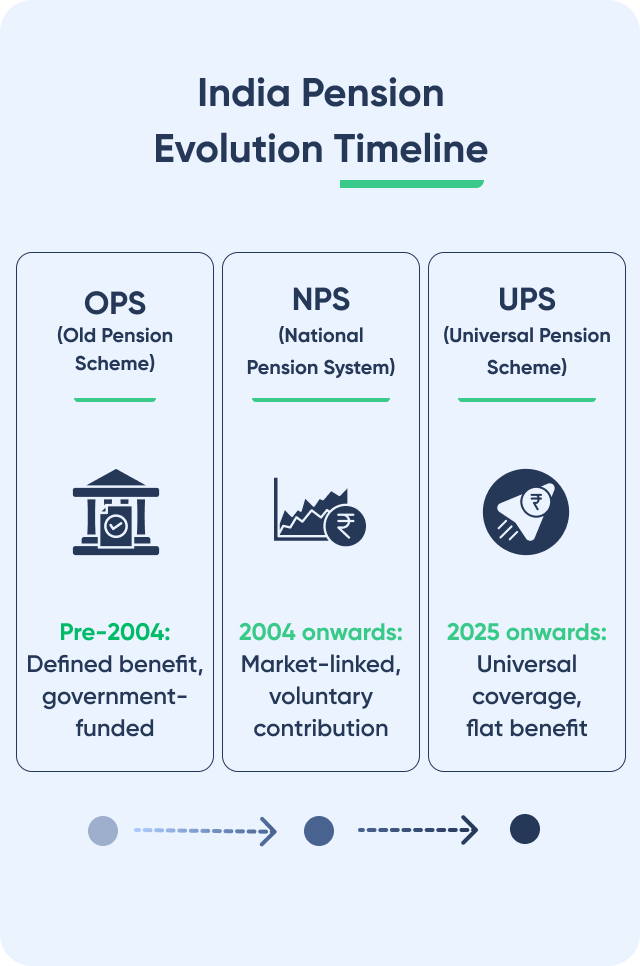

NPS vs OPS vs UPS: Understanding India’s Pension Debate

India’s pension system is evolving, from the guaranteed Old Pension Scheme (OPS) to the market-linked National Pension System (NPS), and now the Unified Pension Scheme (UPS) that blends assurance with sustainability. Here’s how these three compare, and what the shift means for your retirement.

Retirement planning in India is going through one of its biggest cultural shifts. For decades, government employees could bank on a secure, predictable pension that arrived every month, no matter what the economy looked like. But as India's workforce expanded and life expectancy rose, that old model began to strain under its own weight. In 2004, the National Pension System (NPS) replaced the Old Pension Scheme (OPS), shifting the responsibility of retirement security from the government's shoulders to individual contributors.

Fast-forward to 2024, and a new model, the Unified Pension Scheme (UPS) has entered the scene, promising to combine the best of both worlds: the reliability of OPS and the flexibility of NPS. The conversation about pensions today is no longer just about government budgets; it's about trust, sustainability, and the kind of financial security future retirees can expect in a fast-changing economy.

What Is the Old Pension Scheme (OPS)?

Before 2004, the Old Pension Scheme was the default retirement safety net for government employees. It guaranteed that retirees would receive a lifetime pension equal to 50% of their last drawn basic salary plus dearness allowance. The scheme felt secure, no market risks, no uncertainty because the government bore the entire burden.

However, as the number of retirees multiplied, the cost ballooned. Pensions began swallowing up a large part of state budgets, leaving less for education, infrastructure, and welfare programs. OPS, while emotionally comforting, proved financially heavy.

What Is the National Pension System (NPS)?

NPS replaced OPS in 2004 with an approach that emphasized shared responsibility and long-term sustainability. It was extended in 2009 to cover private-sector employees, self-employed individuals, and NRIs. Here, both the employee and the employer contribute monthly to an individual retirement account. The funds are invested across equity, bonds, and government securities to build a corpus over time.

At retirement, one can withdraw 60% of the corpus as a lump sum and use the rest to buy an annuity that ensures income for life. The transparency and portability of NPS make it appealing, but the returns depend on market performance. For many, this replaced certainty with anxiety especially during volatile periods.

What Is the Unified Pension Scheme (UPS)?

Announced in 2024, the Unified Pension Scheme is the government's attempt to strike a balance. It brings back the assurance of a minimum guaranteed pension while keeping the contribution and investment structure of NPS. Under UPS, both the employee and the government contribute (expected around 10% and 14%, respectively), and retirees are assured of a pension roughly around 50% of their last drawn salary, regardless of market fluctuations.

UPS is available to:

- Existing Government Employees under NPS as on 01.04.2025

- New Recruits joining Central Government service on or after 01.04.2025

-

Retired NPS Subscribers who superannuated or retired on or before 31.03.2025, provided

- Minimum 10 years of qualifying service

- Retirement under FR 56(j) (not as a penalty)

- Legally wedded spouse as on date of retirement, in case of subscriber's demise

This hybrid model aims to protect retirees from market extremes without burdening state finances like OPS once did.

OPS vs NPS: Key Differences

To truly appreciate how retirement planning has changed in India, let's look at the core contrasts between the Old Pension Scheme and the National Pension System. Here's a snapshot that lays out their fundamental differences:

OPS offered lifelong assurance; NPS offered modern efficiency but few found peace of mind in market-linked uncertainty.

OPS vs NPS vs UPS: How They Compare

As policy evolves, UPS steps in as a hybrid model. Here's how all three schemes stack up side-by-side, helping us see exactly what's gained, what's lost, and what's newly promised:

(Guaranteed pension with

contribution model)

to pool corpus

from last 12 months

(after 25+ years of service ),

with a minimum ₹10,000/month for

10+ years of service

NRIs, self-employed individuals Central government employees

UPS is being designed as a stable middle ground one that restores faith among employees while keeping the system fiscally responsible.

Policy Perspective: What UPS Signals for India's Pension Future

The Unified Pension Scheme is a signal that India is rethinking what "security after retirement" really means. For years, the debate has swung between two extremes: complete government-backed assurance on one side, and total market dependence on the other. UPS tries to bring the two worlds closer.

By bringing back a guaranteed pension, the government is addressing a deep emotional need, the need for certainty. Many employees who moved from OPS to NPS felt they had lost that comfort of knowing what their monthly pension would be. UPS is meant to rebuild that confidence, while still keeping the country's finances under control.

For policymakers, this is about finding a middle path -- one where promises remain credible, but not unaffordable.For individuals, it's a reminder that retirement planning is becoming more personal than ever. Government employees may find peace of mind in the assured pension that UPS offers. Private-sector professionals will continue to use NPS as a disciplined way to grow their retirement corpus with market-linked returns and tax benefits.

In the long run, India's pension story may no longer be about choosing one scheme over another - but about having the freedom to choose the kind of retirement you want, backed by both policy innovation and personal financial planning.In practice, UPS lowers anxiety about market risk while maintaining the fiscal discipline and transparency that NPS introduced.

The Bigger Picture: Balancing Security and Sustainability

India's pension shift from OPS to NPS, and now toward UPS, tells a story bigger than finance; it's about changing trust. OPS symbolized dependability but drained public funds. NPS rewarded long-term growth but left employees exposed to market swings. UPS proposes a middle way where citizens can retire with dignity and governments can plan sustainably.

For private employees, NPS remains a powerful retirement tool with its compounding growth and tax benefits. But for government employees, UPS could redefine pension security for a new era where assurance and accountability finally coexist.