Portfolio Diversification: Building a Balanced Investment Strategy for Long-Term Wealth

Understand the importance of portfolio diversification and how to balance investments across equity, debt, gold, and other assets. Learn expert-backed strategies to reduce risk and build long-term financial stability.

Most investors begin their financial journey by looking for the “best” investment - a fund, a stock, or a policy that promises high returns. But over time, experienced investors realize that wealth is not built by picking winners; it is built by constructing balance. That balance is what portfolio diversification brings.

Portfolio diversification is the process of spreading your money across different asset classes such as equity, debt, gold, or real estate so that no single investment determines your financial fate. It cushions your savings against unpredictable market swings, reduces overall risk, and ensures that your financial growth is steady rather than erratic. For anyone planning long-term goals like retirement, diversification is not a strategy of the cautious. It is the discipline of the wise.

Why Diversification Is Essential

-

It manages risk without slowing growth

Every asset behaves differently under different economic conditions. Equities can deliver superior long-term returns but can also experience sharp short-term declines. Debt instruments, on the other hand, offer lower but more stable returns. Gold tends to rise during uncertainty, while real estate builds value gradually through time.

A diversified portfolio blends these characteristics in a way that allows stability and growth to coexist. When one segment of your portfolio underperforms, another often steps up to offset the loss. This interplay ensures your overall returns remain positive over long horizons. For instance, during the pandemic-induced market crash in early 2020, investors who had exposure to gold and quality debt funds saw smaller declines than those who held only equities. Over the next two years, as equity markets recovered, their overall portfolio value surged faster because their capital base was protected.

Diversification, in essence, helps you stay invested longer by making volatility more tolerable. That consistency is what compounds wealth.

-

It helps you invest with logic, not emotion

Market cycles test not only portfolios but also patience. When your investments fluctuate wildly, fear often replaces reason. A concentrated portfolio amplifies this emotional strain. By contrast, a well-diversified portfolio behaves more predictably, helping you avoid reactionary decisions such as panic selling during market dips or chasing returns when prices are high.

Behavioural finance studies repeatedly show that the biggest threat to investor returns is not market risk but investor behaviour. Diversification acts as a psychological stabilizer. It smoothens your experience, allowing you to stay disciplined and give time the space to work its compounding magic.

-

It aligns better with goal-based investing

Each financial goal carries its own timeline and risk profile. A 25-year-old investing for retirement can afford market fluctuations in pursuit of higher growth, while a 50-year-old saving for a child's education cannot. Diversifying across instruments allows you to align the right type of investment with the right goal.

You might, for example, allocate long-term money to equity funds or index funds to benefit from compounding over decades, while directing medium-term savings to debt mutual funds or bonds for capital protection. Gold or hybrid funds can serve as stabilizers for uncertain phases. Such mapping ensures that your overall portfolio supports your life's timeline, not just market trends.

How to Build a Balanced Portfolio

Diversification does not mean scattering money randomly across instruments. It is a thoughtful process of creating an allocation that suits your goals, income stability, and comfort with risk. A strong diversification plan should address both what you invest in and how you maintain it.

-

Define Your Investment Goals

The first step to creating a diversified investment portfolio is to clearly define your investment goals. These goals may be retirement planning, saving for your child's education, a house down payment fund, etc. Your goals will impact how you allocate your investments. For example, money you need in the short term should be invested more conservatively.

-

Identify your core asset classes

A well-balanced portfolio doesn't need to be complicated. For most Indian investors, these core building blocks work beautifully:

-

Equity: Fuels long-term growth and helps you beat inflation.

Examples: Equity mutual funds, diversified index funds, or direct stocks.

-

Debt: Brings stability and steady income to your portfolio.

Examples: Debt mutual funds, fixed deposits, or high-rated corporate and government bonds.

-

Gold or Alternatives: Acts as a safety net during uncertain times and protects against inflation.

Examples: Sovereign Gold Bonds (SGBs), Gold ETFs, or REITs for property exposure.

- Cash: Keeps your plan flexible by covering short-term needs or emergencies.

- Real Estate: Offers potential rental income and long-term appreciation, though it's less liquid compared to other assets.

Once this foundation is in place, adjust it based on your age, goals, and changing financial priorities.

-

-

Diversify Within Each Asset Class

True diversification goes deeper than just mixing asset types—it also means spreading risk within them. In equities, don't stick to one market segment. Combine large-cap funds for consistency with mid-cap or flexi-cap funds for faster growth.

For debt, balance short-term and long-duration funds, and mix government securities with solid corporate bonds. Even with gold, you can blend SGBs and ETFs to get both liquidity and steady value.

When you spread your investments smartly within each category, one weak link won't drag your portfolio down - the rest keeps working for you.

-

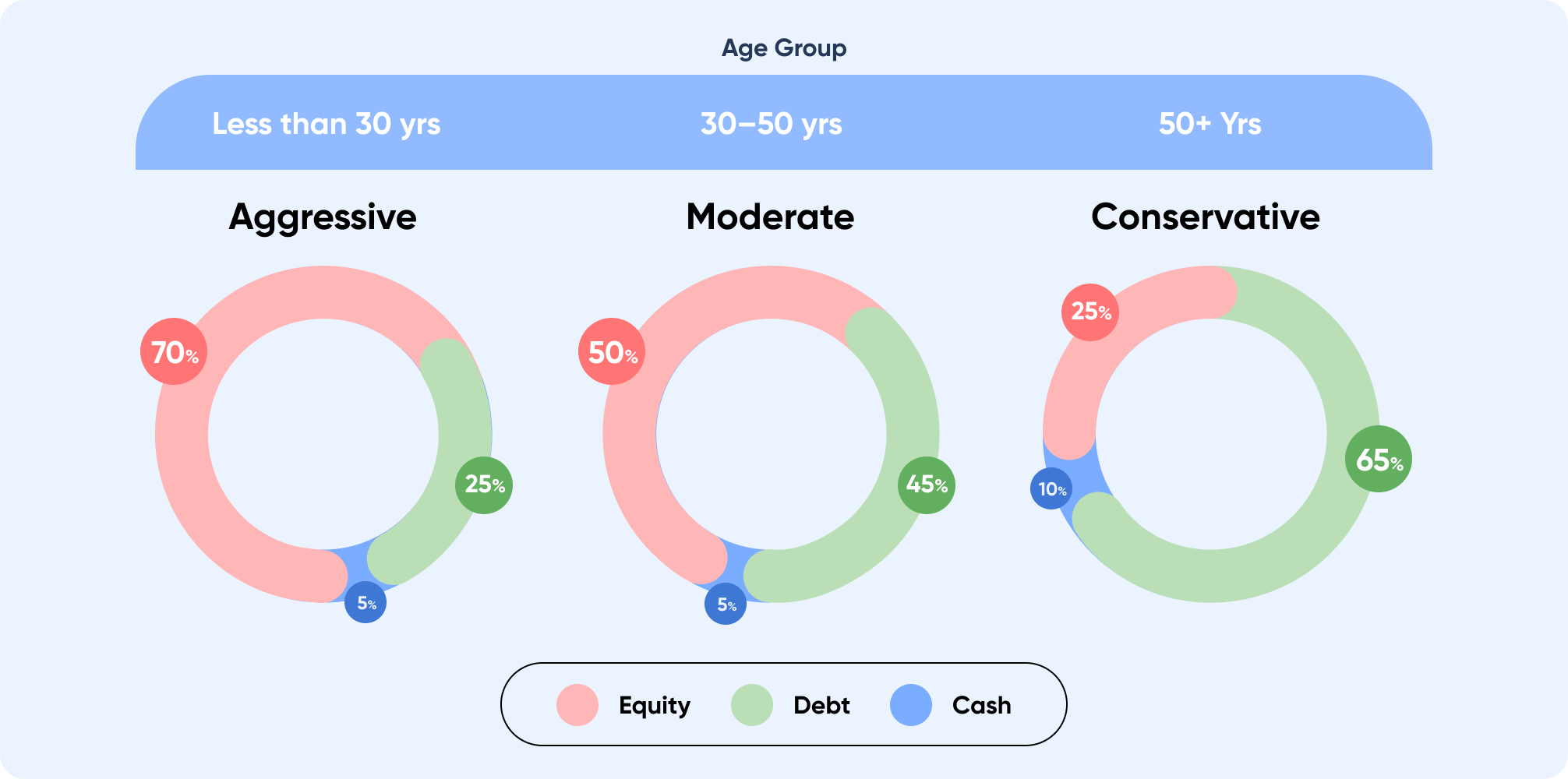

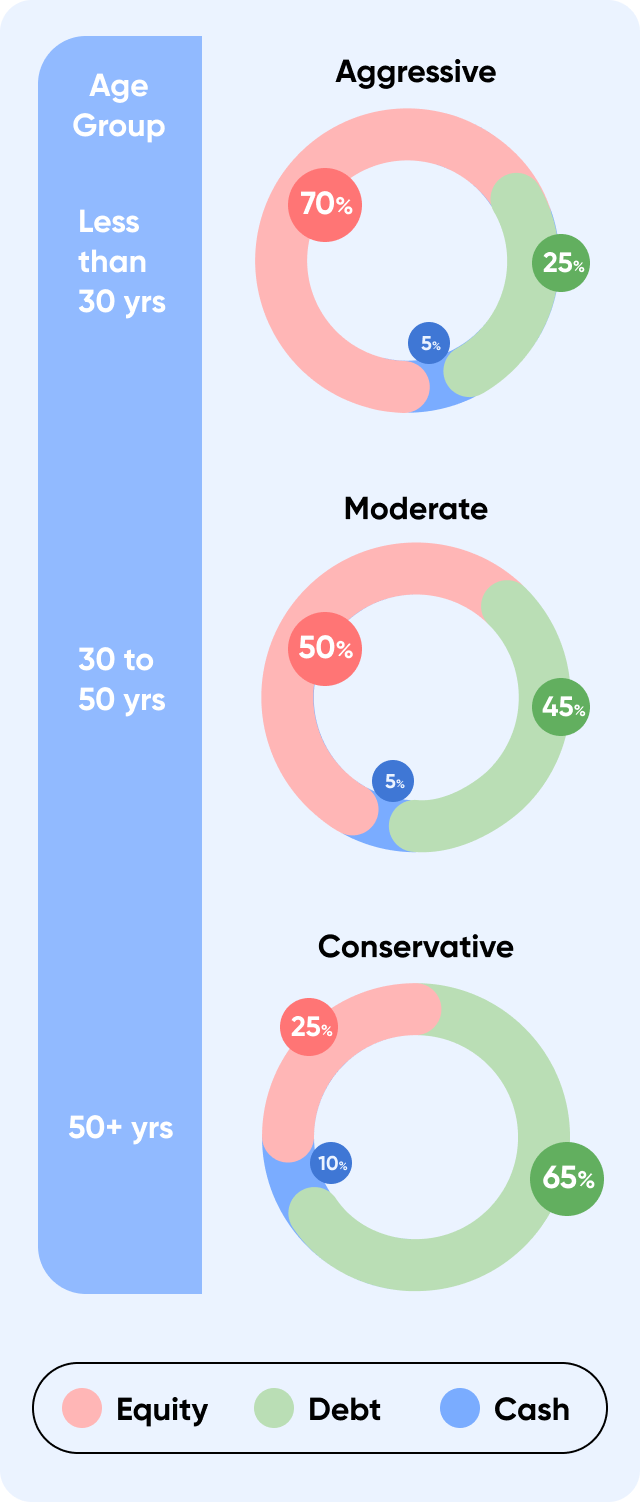

Use an age-based allocation as a starting point

A classic principle that still holds practical value is the “100 minus age” formula. If you are 35 years old, keeping around 65 percent of your portfolio in equities and the remaining 35 percent in more stable assets such as debt and gold provides a healthy balance between growth and protection.

This ratio need not be rigid. What matters is that your portfolio gradually shifts toward safety as you approach retirement or large financial milestones. Think of it as a gradual rebalancing of priorities - from wealth creation to wealth preservation.

-

Review and rebalance periodically

Over time, market performance can distort your original allocation. For instance, if equities outperform debt for a few years, they may become a larger share of your portfolio than intended. This can increase your risk exposure without you realizing it.

Rebalancing once or twice a year helps restore your portfolio to its intended proportions. You can do this by redirecting new investments toward underweighted assets or by partially booking profits from overgrown categories. This disciplined maintenance ensures that your portfolio continues to reflect your actual financial goals rather than short-term market movements.

Final Thoughts

Nowhere is diversification more crucial than in retirement planning. Retirement spans decades, and during that time, inflation, interest rate cycles, and market volatility can dramatically influence your savings. A diversified retirement portfolio helps balance three core objectives: growth before retirement, capital preservation near retirement, and income generation after retirement.

Equities help your savings grow fast enough to beat inflation. Debt ensures your corpus remains stable even during downturns. Gold or hybrid assets add resilience during unpredictable global or domestic events.

Once you retire, diversification continues to serve you through systematic withdrawal plans (SWPs), annuities, or a combination of the two. By maintaining a blend of equity and fixed-income instruments, you can keep drawing a steady income while letting part of your corpus continue to grow. Studies by global investment research firms like Morningstar have shown that balanced portfolios with 60 percent equity and 40 percent debt have historically delivered 8 to 10 percent annualized returns over long periods with much lower volatility than equity-heavy portfolios.

That steady reliability, not short bursts of profit, is what defines successful retirement planning.