Retirement Corpus Planning: The Bucket Method

Most Indians underestimate what it takes to retire comfortably. Learn how to calculate your ideal retirement corpus, manage inflation, and apply the 4-Bucket Strategy to make your savings last a lifetime.

For decades, the idea of retirement in India was simple: you worked until sixty, drew a pension, and lived modestly on savings and family support. But that model no longer holds true. The private sector workforce today has no defined pension benefit, family structures have become nuclear, and the cost of living has risen faster than incomes for many middle-class households.

Surveys suggest that nearly 59% of Indian respondents expect to continue working beyond retirement age, primarily due to inadequate savings. Another global study, the Mercer CFA Institute Global Pension Index, placed India among the bottom three nations for retirement preparedness. These numbers reveal an uncomfortable truth: while Indians are saving more than ever, very few are saving right.

Retirement corpus planning, therefore, is no longer a back-of-the-envelope exercise. It requires a clear understanding of inflation, longevity, and asset allocation and a strategy to ensure that your wealth outlives you, not the other way around.

Why Retirement Corpus Planning Matters Now More Than Ever?

The structure of financial security has changed dramatically in the past two decades. Life expectancy in India has climbed from 62 years in 2000 to over 70.2 years in 2024, according to the World Bank. Medical inflation, meanwhile, has averaged 10-12% per year, far exceeding general inflation of around 5-6%.

This means that even if your daily expenses grow modestly, your healthcare costs will double every six to seven years. For a retiree, that's not a small problem, it's the single biggest financial threat.

In this context, your retirement corpus is not just about maintaining lifestyle; it's about ensuring liquidity for health emergencies, rising living costs, and longevity that could easily stretch your retirement horizon to three decades or more.

How to Estimate Your Retirement Corpus

The starting point of retirement planning is not your salary or net worth, but your lifestyle. You must estimate what it costs to live comfortably today, and what that number will look like after adjusting for inflation and time.

-

Begin with your current expenses

If your household spends ₹1 lakh per month today, you'll likely need at least 70-80% of that amount in real terms after retirement. This figure forms the baseline for your calculations.

-

Account for inflation

At 6% annual inflation, ₹1 lakh today will become roughly ₹4.3 lakh per month in 25 years. That means maintaining the same standard of living at age 60 would require over ₹50 lakh a year and this doesn't include healthcare or discretionary spending.

-

Factor in longevity

With average life expectancy rising, planning for 25-30 years post-retirement is prudent. That's three decades of non-earning years that must be funded by your investments.

-

Adjust for real returns

If your investments generate 7% after tax and inflation averages 6%, your real return is just 1%. That's why retirees need growth-oriented exposure (like equities) even after they stop working not to chase risk, but to maintain purchasing power.

For most Indian professionals in their 30s and 40s, this arithmetic translates into a corpus target between ₹5 crore and ₹8 crore for a comfortable, inflation-adjusted retirement.

Understanding the 4% Rule and Its Indian Context

Once you know how much you need, the next question is how much you can safely withdraw each year without exhausting your corpus. The “4% rule,” popularized in the U.S., suggests that if you withdraw 4% of your portfolio annually (adjusted for inflation), it should last roughly 25-30 years.

While this provides a useful benchmark, applying it blindly in India is risky because

- Inflation is higher and more volatile than in developed markets

- Healthcare inflation consistently outpaces consumer inflation

- Post-tax returns on fixed-income instruments are often lower

In the Indian context, most financial planners recommend a 3.5% withdrawal rate for conservative retirees. This gives a slightly larger safety margin in case of market downturns or unplanned expenses.

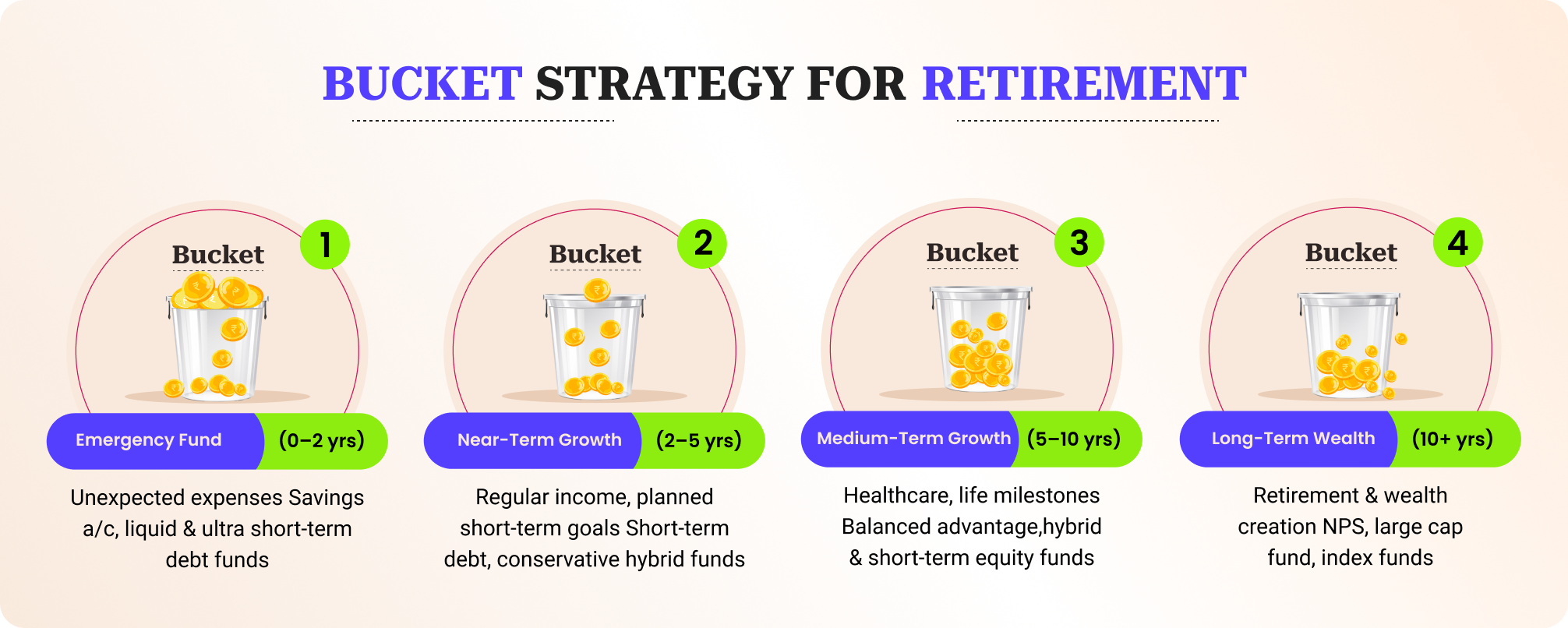

The Four-Bucket Strategy: A Smarter Way to Manage Your Corpus

Building a retirement fund is one thing; making it last is another. That's where the Bucket Strategy helps. It's a simple, structured way to divide your savings into parts, or “buckets,” based on when you'll actually need the money.

Your short-term bucket keeps cash handy for immediate needs. The next few buckets balance safety and growth. And the last one stays invested for the long haul - quietly compounding while you live off the earlier ones.

The idea is to protect your peace of mind as much as your portfolio — ensuring you never have to sell in panic or depend on luck for your post-retirement income.

The structure typically looks like this:

Bucket 1:Emergency Fund(0-1 years)

- Purpose: Emergency medical needs and unexpected expenses

- Instruments: Savings accounts, Ultra short-term debt funds, liquid funds

- Objective: Capital preservation and instant liquidity

Bucket 2: Near-Term Growth (1-5 years)

- Purpose: Provides a steady income stream. Takes care of day to day expenses and planned expenses like education, travel etc.

- Instruments: Short-Term debt funds, conservative hybrid funds

- Objective: Low volatility with slightly higher returns than cash equivalents

Bucket 3: Medium-Term Growth (5-10 years)

- Purpose: Funds healthcare, lifestyle upgrades,, or family milestones

- Instruments: Balanced advantage funds, hybrid mutual funds

- Objective: Moderate growth with capital safety

Bucket 4: Long-Term Wealth (10+ years)

- Purpose: Beats inflation and preserves wealth for late retirement or legacy planning

- Instruments: Equity mutual funds, NPS, index funds, international equity exposure

- Objective: Long-term compounding and inflation protection

If you draw income from Bucket 1 and periodically refill it with returns or partial redemptions from Bucket 2. Meanwhile, Buckets 3 and 4 continue to compound quietly in the background, ensuring your purchasing power keeps pace with inflation.

Why the Bucket Strategy Works?

What makes the bucket framework powerful is not just diversification, it's sequencing. Retirees often face the risk of "sequence of returns," where early market losses can permanently damage the longevity of their corpus. By separating time horizons, you reduce the chance of being forced to sell equity investments during a downturn.

This approach helps because

- You always have at least 2-3 years of cash flow set aside, insulating you from market shocks

- Your long-term money remains invested long enough to recover and grow

- It brings psychological comfort you see income coming in regularly rather than watching one large sum deplete

In effect, the Bucket Strategy lets you convert a static corpus into a dynamic, self-sustaining system.

Common Pitfalls That Erode Retirement Security

Even with the right strategy, execution often fails due to avoidable mistakes. A few recurring ones include:

- Underestimating inflation's long-term impact

- Holding the entire corpus in fixed deposits or traditional insurance products

- Ignoring medical and long-term care insurance

- Failing to rebalance portfolios periodically

- Starting too late and expecting higher returns to make up for lost time

Pro tip →The compounding effect of time cannot be substituted. A 25-year-old investing ₹15,000 per month at 10% returns can accumulate nearly ₹3.1 crore by age 55. The same investor starting at 35 would have to invest around ₹44,000 monthly to reach a similar goal.

Building a Strong Retirement Portfolio

To design a resilient plan, consider layering your investments thoughtfully. Instruments that fit naturally into an Indian retirement portfolio include:

- National Pension System (NPS) - long-term compounding with equity exposure and tax benefits

- Equity or Index Mutual Funds - essential for growth and inflation-beating returns

- Debt Funds or Senior Citizen Schemes - ensure capital stability and regular income

- Health and Term Insurance - protect the corpus from being eroded by emergencies

The idea is not to chase the highest return, but to build a structure that can sustain steady withdrawals without anxiety.

A well-thought-out retirement plan is ultimately an exercise in realism. It demands that you confront inflation, healthcare costs, and market volatility not ignore them. The number you need is not static; it evolves with your lifestyle, family responsibilities, and aspirations.

The Bucket Strategy offers a disciplined, time-tested framework to navigate this complexity. It ensures that your money serves your life, not the other way around. Because retirement, at its best, should be about freedom of choice, not fear of running out.