Systematic Withdrawal Plans(SWP): Turning Your Investments into Steady Income

India's pension system is evolving, from the guaranteed Old Pension Scheme (OPS) to the market-linked National Pension System (NPS), and now the Unified Pension Scheme (UPS) that blends assurance with sustainability. Here's how these three compare, and what the shift means for your retirement.

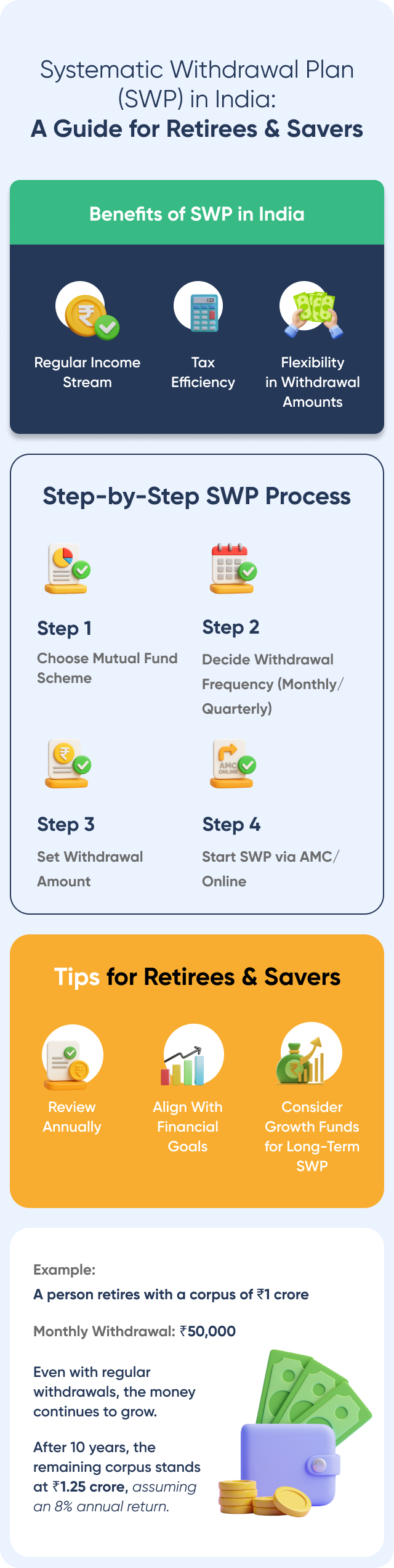

Discover how a Systematic Withdrawal Plan (SWP) can turn your investments into steady income. Learn how SWPs work, their tax advantages, and why they're a smarter alternative to fixed deposits for retirees and long-term investors in India.

There comes a stage in everyone's financial journey when the goal quietly changes. You stop

chasing returns and start seeking security. After years of building wealth, the focus shifts to drawing from it wisely, sustainably, and without uncertainty.

In India, that stage often meant turning to fixed deposits or pension plans that promised predictability. But in today's world where people live longer, inflation moves faster, and lifestyles stretch further, traditional income options don't always keep pace. Retirees and professionals nearing that milestone now want something better: a way to enjoy steady income without locking their money away or losing growth potential. This is where the Systematic Withdrawal Plan, or SWP, comes in.

What is SWP And How It Works

Think of SWP as the mirror image of a Systematic Investment Plan (SIP). With an SIP, you invest a fixed amount regularly to build wealth. With an SWP, you do the reverse - withdraw a chosen sum at regular intervals from your existing mutual fund investment. It's like paying yourself a monthly salary while your remaining money continues to stay invested and grow.

In essence, an SWP allows your investments to work for you offering consistent cash flow, flexibility, and better tax efficiency, all while your capital remains active in the market.

Imagine you've built a Rs 20 lakh corpus in a balanced mutual fund. You set up an SWP of Rs 15,000 per month. Each month, that amount is credited to your bank account by redeeming a few fund units, while the rest of your investment remains in the market, potentially earning more.

Instead of cashing out everything at once or depending on uncertain dividends, you can turn your investments into a flexible, reliable income stream that moves at your pace.

-

Build Your Investment

Start by putting in a lump sum or setting up easy monthly SIPs. Over time, as your fund grows, you can begin drawing from it whenever you're ready.

-

Choose How You Get Paid

Decide how much you want to withdraw—and how often. It could be monthly, quarterly, or yearly. You have full control and can tweak it anytime.

-

Automatic Withdrawals

On each payout date, the fund automatically redeems just enough units based on the current NAV to deliver your chosen amount.

-

Money Straight to Your Bank

Your withdrawal reaches your bank within a day or two—it feels like receiving a salary, except the paycheck comes from your own investments.

-

Your Balance Keeps Working

The rest of your investment stays in the market, continuing to grow and earn while you enjoy regular payouts.

Why Investors Prefer SWP Over Traditional Withdrawals

The growing preference for SWPs among Indian investors isn't accidental. It's driven by the unique balance they strike between liquidity, tax-efficiency, and growth. Let's explore what makes them stand out:

-

Steady, Predictable Income

An SWP offers a consistent flow of money monthly, quarterly, or annually helping retirees or anyone supplementing their income manage costs confidently without eroding their capital too fast.

-

Better Tax Efficiency

Unlike fixed deposit interest, which is fully taxable, SWPs tax only the gains portion of each withdrawal. And if you've held the investment long enough, the tax falls under favorable long-term capital gains rates making SWPs among the most tax-efficient income options in India.

-

Keeps Money Growing

The unredeemed portion keeps compounding, helping your portfolio outpace inflation. Over time, this can extend the life of your corpus compared to leaving it idle in a savings account or FD.

-

Flexibility and Control

You decide how much to withdraw, how often, and when to pause or stop. You can even adjust payouts as your lifestyle or market conditions change.

-

Less Market Timing Anxiety

SWPs reduce the pressure of withdrawing at the wrong time, as your redemptions are spaced evenly smoothing out market ups and downs.

A Real-Life Example

Renu, 58, retired with Rs 30 lakh corpus Instead of moving it all to fixed deposits, she chose an SWP of Rs 25,000 per month from a balanced hybrid fund.(assuming return of 8%)

Her monthly expenses were comfortably covered, her remaining corpus kept compounding, and even after 10 years during which she withdrew Rs 30 lakh in total her investment was still close to Rs 20 lakh.

That's the unique power of an SWP: income today, growth for tomorrow. Traditional instruments rarely offer both.

When an SWP Makes Sense

It's ideal for retirees who want a steady income without giving up market participation. It also works for freelancers or business owners seeking predictable payouts from accumulated investments. Tax-conscious investors benefit from its capital gains treatment over interest taxation, while parents planning phased withdrawals for education or travel can use it to match expenses over time.

In short, an SWP fits anywhere you need regular cash flow with continued growth. But like any financial strategy, an SWP works best when done thoughtfully.

Start by choosing the right fund. Hybrid or balanced advantage funds suit medium-term horizons, while equity-oriented funds serve longer-term goals. Withdraw wisely, sticking to a sustainable annual withdrawal rate (around 6-8%) ensures your corpus lasts through all stages of retirement. And don't set it and forget it; review your plan annually to account for inflation, lifestyle shifts, or fund performance. This periodic fine-tuning keeps your SWP aligned with both your goals and the market reality.

An SWP turns your accumulated wealth into a self-tailored pension giving you regular income, market participation, and tax efficiency in one simple strategy. For those ready to move beyond fixed deposits and embrace flexible financial freedom, SWPs provide a balanced bridge between stability and growth.