Employer's Contribution to NPS

When we start with our first job, the last thing that comes into our mind is whether the pay cheque is good enough for retirement. This is where retirement planning collapses.

While nearly 90 percent of India's workforce remains outside formal pension coverage, participation in structured retirement solutions is steadily improving. The number of NPS contributors has grown to around 90 million, with aggregate assets under management reaching approximately ₹16 trillion by October 2025, reflecting rising awareness and adoption of retirement planning in India.

The introduction of employer contribution to NPS was in 2004 by the Government of India for its employees . It was extended to corporate employees and NRIs by the PFRDA (Pension Fund Regulatory and Development Authority) in 2013, providing tax-free ways for employers to enhance their employees' retirement savings.

This is why we are here to help you understand all about its limits, mandates, and benefits that can assist employees from taking advantage of this free bonus to enhance their retirement savings.

What is Employer Contribution to NPS?

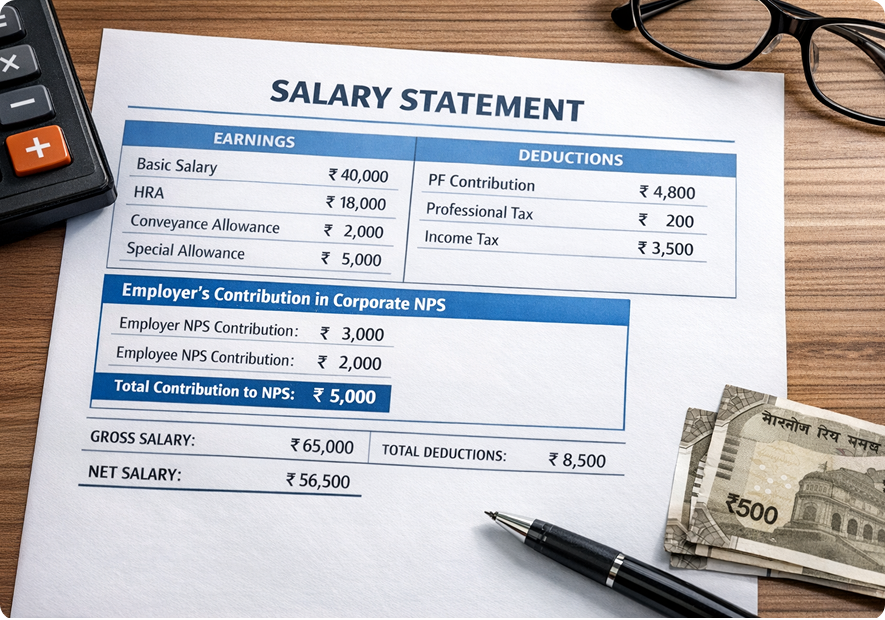

An employer contribution to NPS is a portion of your salary that your employer deposits into your NPS Tier I account. This increases your retirement savings at no cost to you. This differs from personal contributions in that it is voluntary in the case of a private sector company or mandatory in the case of government or public sector undertakings.

It is typically offered in tandem with an employee's contribution. The investments made with these funds typically include equity up to 75% of your employer's contribution, corporate bonds and government securities and have, over time, been market linked with expected returns of 9%-12%.

When it comes to an employer contribution to NPS, it is limited by an employer's own interests to ensure its fair across all staff and also budget constraints.

- Under the Income Tax Act (Income Tax Referral Documentation), an employer's contributions to NPS are capped at 10% of base pay + DA (dearness allowance) for old tax regime & 14% of base pay + DA for the new regime

- And the employers who fall under Central Government or banking institutions have a little more of a cap with the total combined employer contribution being capped at 14%.

How Much Can Employers Contribute to NPS?

The caps for employer NPS contributions, which provide insight into how to maximize this benefit, are determined by the Income Tax Act to strike a balance between growth and fiscal stability. .

-

Private Sector Limit: 10-14% of Basic + DA

Corporations can take advantage of the 10-14% monthly contribution to NPS for employees. For example, an employee earning Rs 50,000 and opted for the old tax regime has Rs 5,000 available in free contribution toward their NPS account tax-free to the corporation, which allows for additional compounding to grow their investment.

-

Government/PSU Cap: 14% of Basic + DA

Both central and state governments, as well as banks, are required to deposit 14% of their employees' salaries into their employees' NPS accounts. For example, an employee with a base salary of Rs 40,000 will have Rs 5,600 deposited every month into their NPS account.

Tax Benefits of NPS Contributions: Employees vs Employers

NPS tax incentives significantly enhance the benefits received by both employees and employers.

Example: Rs 10L salary, 10% employer contrib = Rs 1L deduction; saves Rs 30K+ tax at 30% slab.

Key Benefits of Employer's NPS Contribution

The Employer NPS is not just a financial perk, it is also a way to build wealth for retirement effortlessly. It provides a multiple of the employer contributions on your behalf without requiring any additional effort from you to save.

- Firms are recruiting employees by offering attractive retirement planning approaches through NPS contributions: you can receive assurance of employment for life by saving for retirement. Voluntary for private sector employers, the demand for NPS is huge. Many employers will match your contributions 50-100%.

- The Corpus Booster feature creates an additional Rs 60,000 plus per year for nothing. If you invest Rs 5000/month, by the time you retire in 25 years at a 10% interest rate, the value of that investment will be approximately Rs 65 lakh; therefore, this is an added benefit of being an NPS contributor.

- The Portability feature of NPS means that your NPS account (PRAN number) is not lost if you change jobs. If you leave one company to work for another, you will retain your PRAN and continue to contribute to the NPS account.

- The Inflation Fighter feature of NPS is that market returns (historically, market returns have been 9% to 16%) are much higher than fixed deposits and public provident funds (PPF); additionally, if you invest in equities, you can protect yourself against the rise in inflation rates by investing in a diversified portfolio of equities with up to 75% equity exposure.

Key Takeaways On Retirement Savings With Employer's Contribution to NPS

As an employee, by using your employer NPS as your main source of retirement savings, you will receive tax-free growth that will compound over the years to become several crores. Your employer will save money through deductions and the money they save will be used to fund your retirement. To start using this process today, contact your company's HR Department. If you are not currently participating in an employer NPS, please set up a personal NPS with eNPS. Acting today will increase your ability to retire in the future to enjoy the retirement you deserve.

FAQs

The maximum amount that can be contributed by an employer towards the NPS is 10% of Basic + DA in the case of the private sector and 14% if you have a job with a Government/Bank. The total combined limit for both Private and Government contributions is Rs. 7.5 lakhs.

In the case of private employers, the contribution made by the employer is not compulsory, while in the case of Government employers, after 2004, the employer's contribution must be made. The employer's contribution, for most of the Central Government and Public Sector Undertakings and State Government employees, is compulsory.

If your employer is making a contribution to NPS on your behalf, then you can claim the tax exemption for this under 80CCD (2). The maximum taxable amount that can be claimed under the employer's contribution is the same as the maximum amount that can be claimed on your own contributions to NPS under 80CCD (1).

You can open a Tier I personal account using the electronic eNPS facility and claim self-deduction up to Rs. 2 lakhs under section 80CCD (1). You can also encourage your employer to administer this tax exemption on behalf of the employees under section 80CCD (2).